Why team transitory is still wrong

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The transitory versus permanent inflation debate has suffered from vague definitions. With price growth in the US and Europe now tumbling, those on “team transitory” are somewhat smug. But of course, anything can be “transitory” on an unspecified timeframe.

Definitional gripes aside, today’s rapidly falling inflation is insufficient to prove that it was always going to fade by itself. What matters is whether it would be even higher now had central banks not tightened monetary policy. The evidence suggests so.

To avoid hindsight bias, it is worth casting minds back. Global inflationary dynamics over recent years have been driven by the pandemic and Russia’s invasion of Ukraine. This led to shocks in supply chains, energy and food. Some argued the that since these were largely supply-side matters, which monetary policy cannot change, and which will simply dim with time anyway, central bankers need not react.

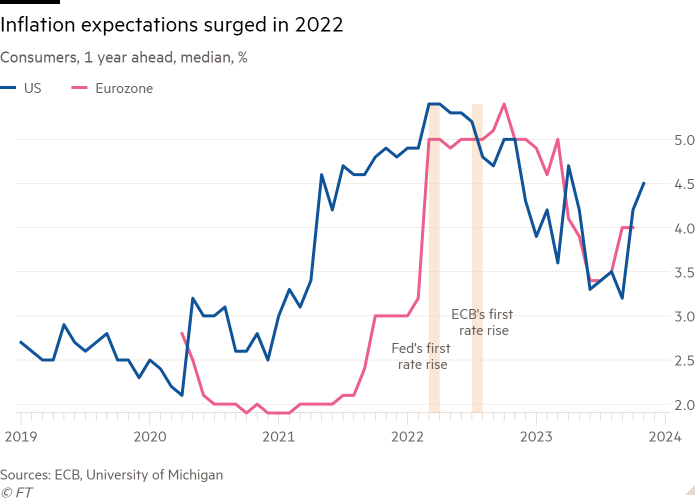

But what mattered was whether the supply deficiency, transient or otherwise, would be enough to spark inflationary dynamics. As the various shocks were indefinite — who knew how quickly Europe would restore gas supplies, or when China would reopen? — they risked amplifying each other, changing expectations and pricing behaviour. Indeed, central banks started belatedly tightening policy when it was clear that inflation expectations and wage growth was picking up. If they had not acted, what might have happened?

Allianz Research has disaggregated the 9 percentage point drop in America’s quarterly annualised inflation since the second quarter of 2022 using regression analysis. It finds 5.5pp of the drop was indeed driven by supply-chain snags simply unwinding. But it also attributes 2.7pp to the Federal Reserve’s signalling, which helped to re-anchor inflation expectations. Another 2.2pp comes from the impact of higher rates squeezing demand, which was needed to counteract the inflationary impact of supportive fiscal policy and labour shortages.

Maxime Darmet, Allianz’s senior US economist, said without the Fed’s actions and its tough words, quarterly annualised inflation would be 6.1 per cent in the fourth quarter of this year compared with the previous three months, instead of 0.7 per cent.

Europe’s experience, in contrast, has arguably been more transitory. The drop in its inflation has primarily been driven by the unwinding of its natural gas and food price shocks. But nonetheless, year-ahead inflation expectations hovered around 5 per cent for most of 2022. And annual negotiated wage growth reached 4.7 per cent in the third quarter.

“Had the ECB left its deposit rate below zero over the past two years, I have no doubt that the labour market would be even tighter today, wage growth would be higher and — very likely — inflation expectations would have risen,” said Andrew Kenningham, chief European economist at Capital Economics.

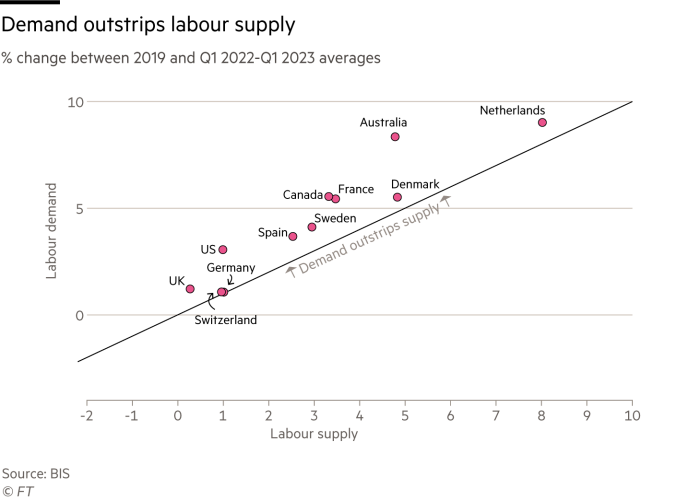

There is also mounting evidence of non-transitory changes in labour markets across advanced economies. Research by the Bank for International Settlements shows the change in demand for workers outstripping the change in the supply since the pandemic across several European nations and the US. This means there is some underlying upward pressure on wages, which warrants central bank action to restrain demand, particularly if productivity growth is subdued.

Econometric research by the Bank of England shows that even in the absence of any inflationary shock in 2020 and beyond, UK inflation would have still been double the target by the second quarter of this year. Given how tight the labour market was in 2019, the Monetary Policy Committee would have had to take action anyway. The pandemic pulled down worker supply even further.

Fitch Ratings expects UK, Eurozone, and US inflation to still be above target by the end of 2024, ranging from 2.5 to 3 per cent. “The fact is that core inflation, services inflation and nominal wage growth all remain well above rates compatible with inflation getting back to target on a sustained basis,” said its chief economist, Brian Coulton. “And this is 30 months after the initial jump in goods prices in April 2021 and after 20 months of very rapid monetary policy tightening.”

A significant amount of the recent inflationary episode was indeed transitory. But there were also more lasting elements. And within the transient factors there were dynamics that would have become embedded. That made central bank action necessary. The focus of the debate should not be on whether they should have acted, but rather, by how much. That is even more complicated.

Comments